.jpg)

What is swing trading?

Definition and core principles

A swing trader is a person who attempts to profit from “swings” — price fluctuations within more significant market trends. Swing trading involves holding medium-term positions, usually for a few days to a few weeks — longer than intraday traders but shorter than long-term investors. Swing traders identify longer market trends, such as uptrends, downtrends, and consolidation, and possible movements within those trends.

How swing trading works

Swing trading is all about identifying longer trends and following them for days or weeks at a time. Common significant trends a trader can identify and follow on the market include:

Uptrend — a series of higher highs and lows.

Downtrend — a series of lower highs and lows.

Flat or consolidation — a period of sideways price movement before a possible breakout.

These trends are further analyzed to make a trading decision. Swing traders rely on fundamental and technical analysis to determine the probability of a particular asset's upcoming price growth or decline.

Often, the first step involves fundamental information, which is used to make assumptions about an asset.

For example, an OPEC meeting may impact oil prices, so traders often rely on expert forecasts regarding the decisions that will be made at the meeting. This fundamental information serves to identify possibilities for long-term changes.

The assets are then further analyzed with technical indicators (MACD, RSI, MA/EMA/SMA, etc.) to select those with good price movement potential and find the best entry points.

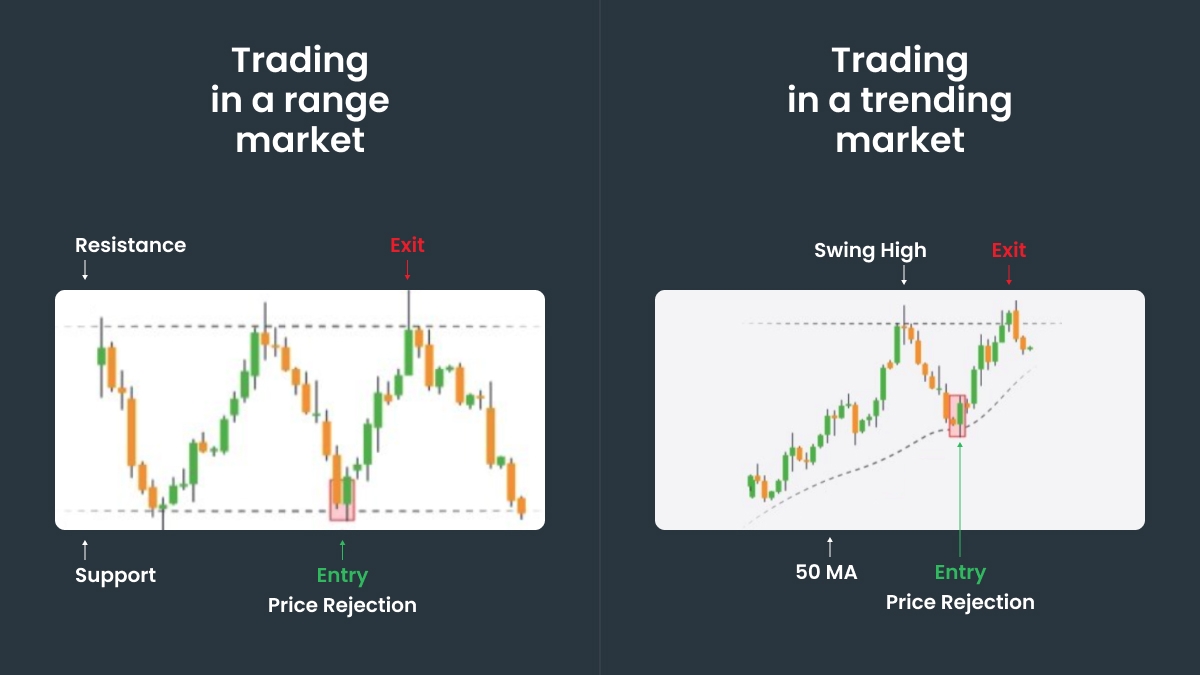

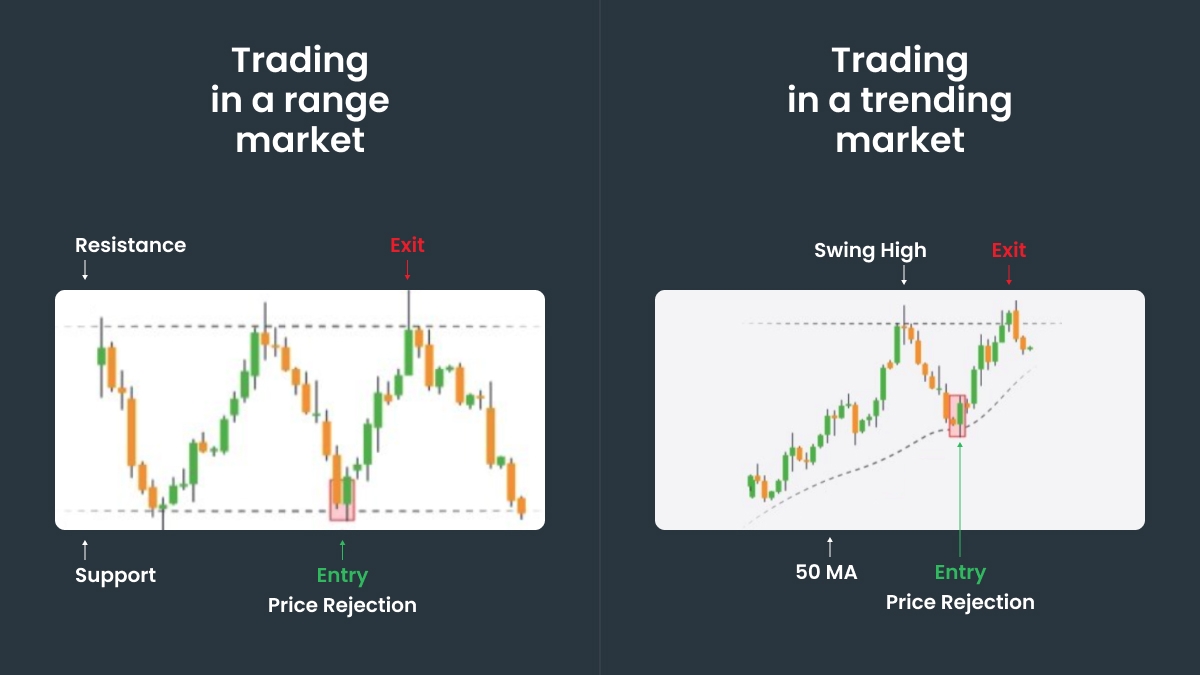

Key market conditions for swing traders

Markets with clear uptrends or downtrends provide the best conditions for swing trading, as they suggest predictable price movements.

Range-bound markets are also promising: they move within defined support and resistance levels, without clear trends. Traders usually buy near support and sell near resistance, having set stop-loss orders beyond these levels.

Trading in a high volatility period can lead to significant profit, but also increases risk. Traders use volume and volatility indicators like ATR to measure potential price swings.

Want to start swing trading? Open an FBS demo account!

How swing trading differs from day trading and investing

Swing trading, day trading and investing have different objectives, timeframes and strategies. Swing trading is a middle ground between investing and day trading. Let’s take a closer look.

| Day trading | Investing | Swing trading |

Timeframe | From seconds to hours, within a trading day. | From months to years. | From a few days to several weeks. |

Objective | Small but frequent profits from many trades. | Larger profits from capitalization and/or dividends with lower risks. | Larger profit compared to day trading, but within a shorter period than investing. |

Strategy | Uses small price movements, relies on technical analysis. | Focuses on long-term trends and potential, relies on fundamental analysis. | Combines both technical and fundamental approaches, tracks trends within a longer period than day trading. |

Risks | Higher due to rapid market volatility. Also day traders face leverage risks and specifics of stop-loss executions. | Generally lower, but there are interest rate, credit and inflation risks. Investors often have less control over their capital than traders. | Swing traders have to deal with overnight and weekend risks, market instability and stop-loss challenges. |

Popular swing trading strategies

1. Trend following

Trend following involves trading in the direction of an already established trend, using technical indicators to confirm momentum. The indicators to look at:

moving averages (for example, 50-day and 200-day MA). They help to identify trends: when a short-term MA crosses above a long-term MA (golden cross), it’s a bullish trend, while a bearish signal happens when the opposite occurs (death cross).

trend indicators. The average directional index, or ADX measures trend strength, while MACD (moving average convergence divergence) helps confirm momentum shifts.

2. Support and resistance trading

This strategy focuses on key price levels where the market reverses:

Traders may buy near the support level and set a stop-loss just below it if a stock repeatedly bounces off it.

3. Breakout trading

This approach aims to capture price movements that occur after key levels break. To use it, first, look for price consolidation near a support or resistance level and wait for a breakout. Also confirm volume — high trading volume on a breakout suggests strong momentum.

4. Reversal trading

Reversal trading is about finding opportunities when a trend is losing momentum. Traders use the RSI (relative strength index) or MACD to spot momentum weakening before a trend reversal. Patterns like doji, hammer, or engulfing candlesticks also signal potential trend reversals.

Key indicators used in swing trading

Moving averages

MA helps identify trends and support or resistance levels.

Entry signal: buy when the 50-day MA crosses above the 200-day MA (golden cross).

Exit signal: sell when the price drops below the 50-day MA in an uptrend.

Relative strength index (RSI)

RSI measures momentum and overbought (or oversold) conditions (0-100 scale).

Moving average convergence divergence (MACD)

MACD is helpful when you want to identify trend changes and momentum shifts.

Bollinger bands

Bollinger bands are invaluable if you want to measure price volatility and potential reversals.

How to develop a swing trading strategy

Step 1: Identify a market trend

Moving averages, trend indicators, and chart patterns are great tools to identify the current trend in the market. After you’ve found one, look for confirmation across multiple timeframes — make sure it’s a long-term trend, not just a fluctuation. For example, if you see a 50-day moving average that is above a 200-day moving average (and both are going upwards), this is definitely a trend.

Step 2: Choose an entry point

What is the optimal entry point? It could be during a pullback to a key support level or a breakout above a resistance, but make a decision based on the trend you identified in Step 1.

Step 3: Set stop-loss and take-profit levels

Risk management is everything: limit potential losses with a stop-loss order, which serves as a safety net. Take a specific percentage of the position, a key support level, or a technical indicator into consideration. The take-profit level can be based on a target price or key resistance level.

Step 4: Monitor and adjust your trades

Closely monitor the market and trade conditions, adjust stop-loss and take-profit levels if needed. If the trend isn’t favorable, consider closing the positions earlier to mitigate the risks and lock in the profit.

Want to improve your swing trading strategy and gain more profit? Go to FBS!

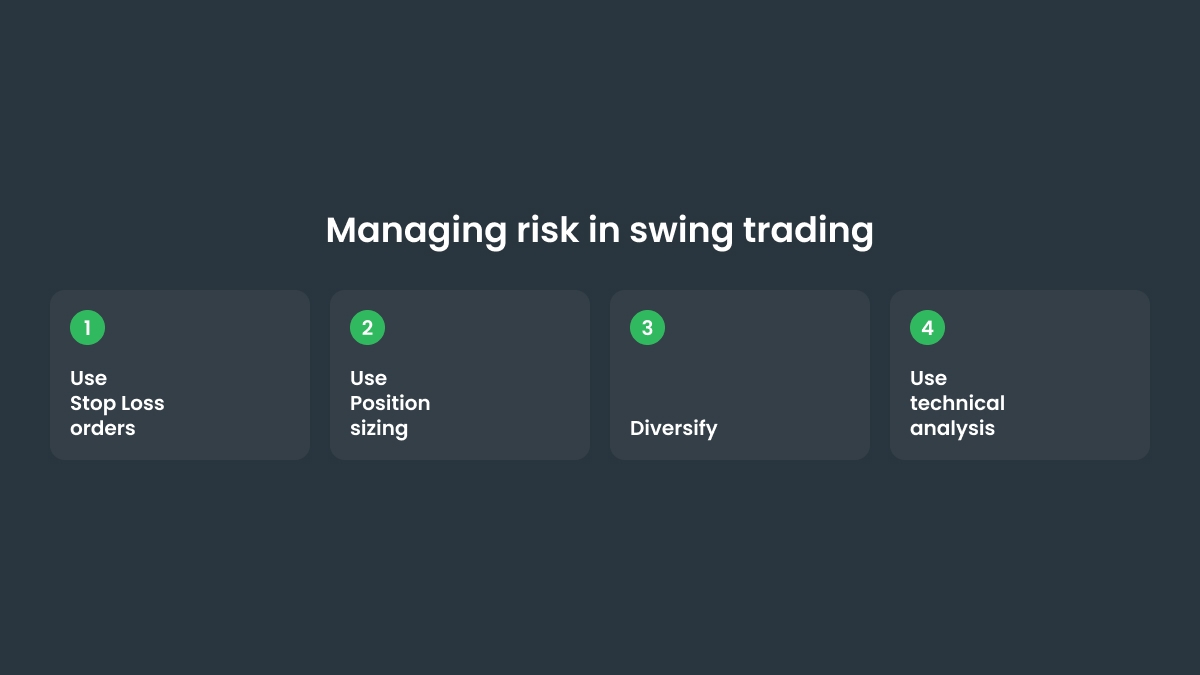

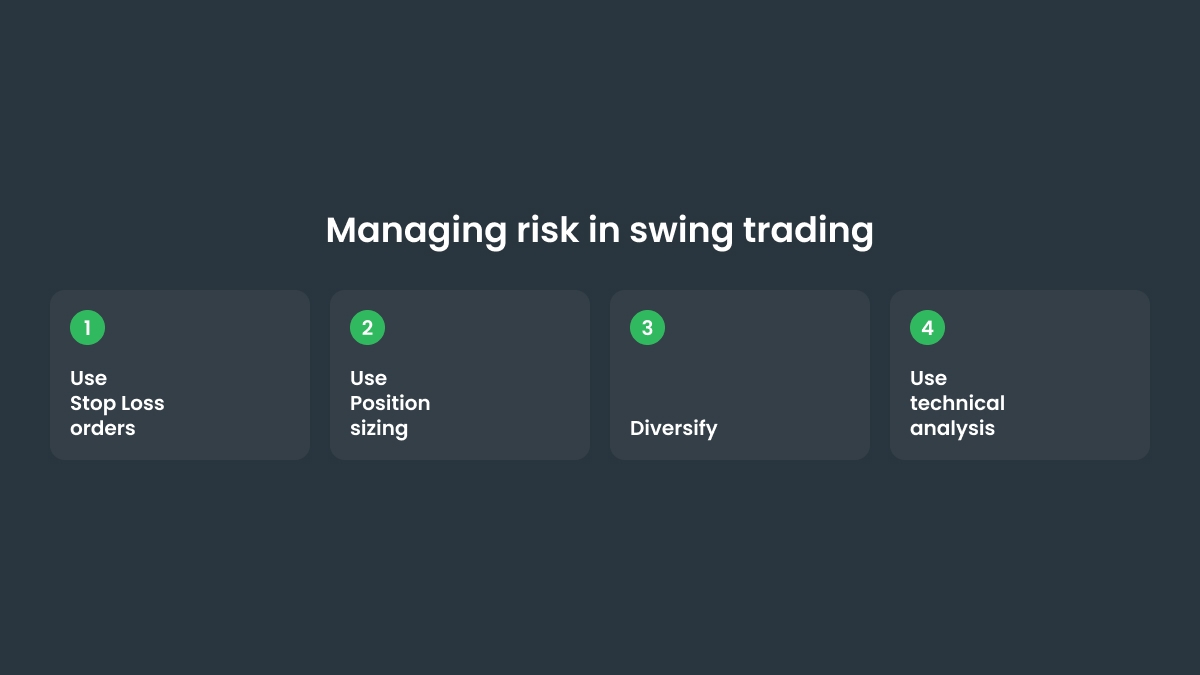

Risk management in swing trading

Setting proper stop-loss levels

There are two types of stop-loss order: hard (sells automatically when the level is reached), and soft (warns the trader, but doesn't sell automatically). It’s up to you which one to use. Prepare a plan for closing out losing positions.

First, identify key support and resistance levels — technical indicators, oscillators and moving averages can help you. It’s a good idea to place your stop-loss orders below support levels for long positions and above resistance levels for short positions.

Another key factor is market volatility: more volatile markets require wider stop-loss orders. Also consider the risk-reward ratio: aim for at least 1:2 or higher.

Stop-loss levels should be reviewed and adjusted regularly.

Managing position sizing

Before allocating position size, identify your risk tolerance, capital, and the potential reward-risk ratio of the trade.

A common approach is to limit position size to a certain percentage of total equity — this is to make sure that you won’t be exposed to a level of risk you can’t handle.

Don’t forget to diversify — it’s one of the most important risk management techniques.

Allocate a special risk budget for each trade to manage the overall risks.

Controlling emotional trading

Know yourself: be aware of your own emotional biases — greed, fear, etc. Don't let them lead to impulsive decisions.

Maintain patience and discipline.

Reflect on your decision making with a trading journal.

Swing trading is secure with FBS. Start your journey now!

Pros and cons of swing trading

As with any trading style, swing trading is imperfect and may not work for everyone. To figure out if swing trading is for you or if you should stick to other styles, start by understanding the pros and cons of the approach.

Advantages

Flexibility

Since swing trading does not require you to constantly monitor the market and stay online to make prompt decisions and close your positions, it works well for really busy people or those with a full-time job. Swing trading may be considered your source of passive income: you only invest a few hours in analyzing the markets and opening your positions, and then you simply wait for your positions to close with a profit.

Less stress

Swing trading causes much less stress to traders than day trading. That’s because a trader generally opens fewer trades and has more time to make decisions, so they are free of the pressure that is natural in short-term trading. Of course, any decision you make may need more effort and concentration per trade, but a slower pace still reduces the stress level.

Potentially higher profits

Since swing trading takes advantage of large price movements, it may result in higher profits. When a market trend is identified and a trader notices possible movements, they may open a position that will bring significant profit in a few days or weeks.

Disadvantages

Overnight event risks

If your positions are left open overnight, there may be unexpected news and gaps that will impact the price of your asset. You may miss the news and fail to respond appropriately. Or the news will cause the price to go opposite what you expected.

Discipline required

You need to develop and follow your trading plan with only minor adaptations. Sticking to your predefined profit goals and risk levels may be a real challenge, so this approach is only for disciplined traders. If you tend to be tempted by short-term market movements and are prone to doubts, you may find swing trading too difficult.

Skills and experience required

If you want to succeed in swing trading, you must know and apply technical and fundamental analysis. This comprehensive skill set is something traders accumulate with years of experience. So, while in other approaches it may be sufficient to follow expert advice and open a short trade, swing trading requires you to utilize your own skills and market knowledge.

Common mistakes in swing trading

Ignoring risk management

Don’t fall into the trap of chasing potential profits and neglecting risk management. It can lead to huge losses. Use stop-loss orders to limit downside risk, follow the 1-2% rule (risk no more than 1-2% of your capital on each trade) and aim for a risk-reward ratio of at least 1:2.

Overtrading

Don’t overtrade — this tendency is often based on emotions. Instead stick to a well thought-out plan with clear entry and exit rules and focus on quality rather than quantity (only trade high-probability setups). Also take breaks after consecutive losses to avoid revenge trading.

Entering trades without confirmation

Don’t jump into trades without confirming signals. It can lead to false entries and poor profit.

Wait for confirmation signals from not just one, but multiple indicators (for example, moving average crossover + RSI oversold). Don’t forget to use volume confirmation when trading breakouts (higher volume suggests stronger breakout).

FAQ: key questions about swing trading

Is swing trading profitable for beginners?

Swing trading is an approach that depends heavily on your skills and dedication. If you understand longer market trends, know and utilize fundamental and technical analysis, and manage your risks appropriately, you can expect your positions to bring consistent profit. However, it may sound more straightforward than it actually is because there is always the chance of unexpected overnight events that may damage your carefully planned positions.

How much capital do you need to start swing trading?

Start small, focus on risk management, and scale up as you gain experience. Anywhere from $2 000 is good (but there is no legal minimum, so it’s up to you). $10 000 is generally considered ideal.

What is the best timeframe for swing trading?

Seasoned swing traders often use multiple timeframes:

the daily chart (1D) is best for identifying swing trade setups and trends.

the 4-hour chart (4H) helps fine-tune entry and exit points.

the 1-hour chart (1H) is used for detailed trade timing and stop-loss placement.

Use the higher timeframe (daily) to identify the trend direction and a lower timeframe (4H or 1H) to establish the precise entries.

.jpg)