Introduction

To successfully execute trades and control risks in a volatile market, every trader needs to know about limit orders. A limit order allows traders to set a specific price at which they are willing to buy or sell an asset. By defining price levels, traders can maintain control over their trades and avoid unfavorable price movements. Understanding the different types of limit orders is essential to implementing well-planned trading strategies. Limit orders allow control over the price of an execution, but they do not guarantee that the order will be executed immediately or even at all.

What are limit orders?

A limit order is a type of order that allows traders to buy or sell an asset at a predefined price or better. Unlike market orders, which execute at the best available price, limit orders ensure price control, making them an essential tool in volatile markets.

Types of limit orders:

Buy limit order – This order is placed below the current market price. It ensures that the trader buys the asset only at the specified price or lower.

Sell limit order – This order is placed above the current market price. It ensures that the trader sells the asset only at the specified price or higher.

Stop limit order – A combination of a stop order and a limit order, this type allows traders to specify both a stop price (trigger point) and a limit price (execution price).

Understanding these different types of limit orders helps traders optimize their entry and exit strategies, ensuring better risk management and improved trade execution.

What is a stop limit order?

A stop limit order is an advanced trading tool that enables traders to set flexible conditions for trade execution. It consists of two key components:

Once the stop price is triggered, the order converts into a limit order, meaning it will only execute at the specified limit price or better. However, if the market price moves too quickly beyond the limit price, the order may remain unfilled.

How a stop limit order works

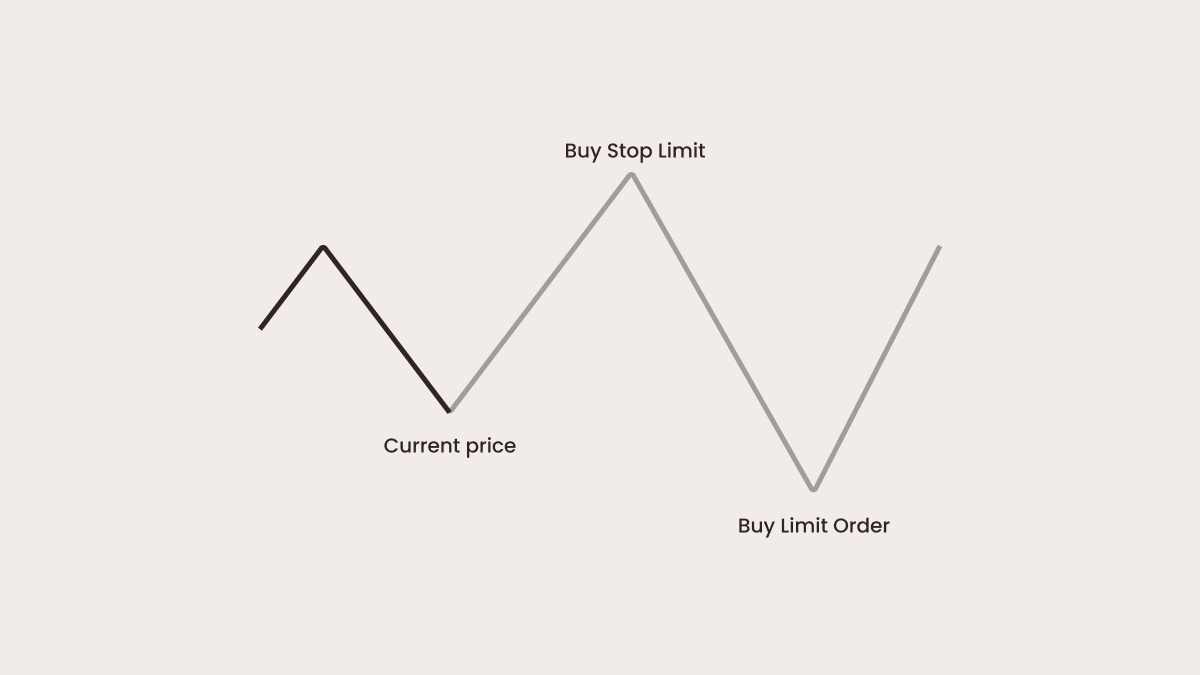

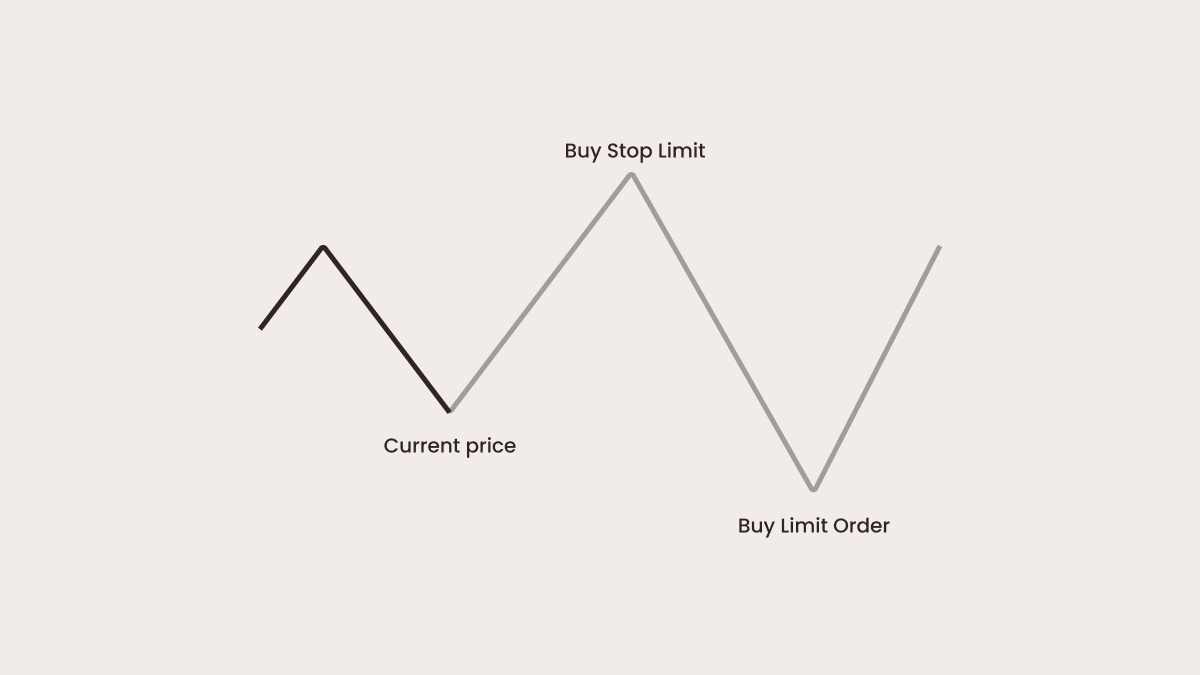

A stop limit order provides traders with control over market entry points, reducing the risk of slippage. Unlike a regular limit or stop order, which is executed as soon as the price is reached, a stop limit order first sets a limit order when the desired price is reached and executes it only when the limit price is reached.

This type of order is particularly useful in fast-changing markets where price fluctuations can be significant. By setting both a stop and limit price, traders can avoid unexpected price fluctuations that might otherwise lead to an unfavorable trade outcome.

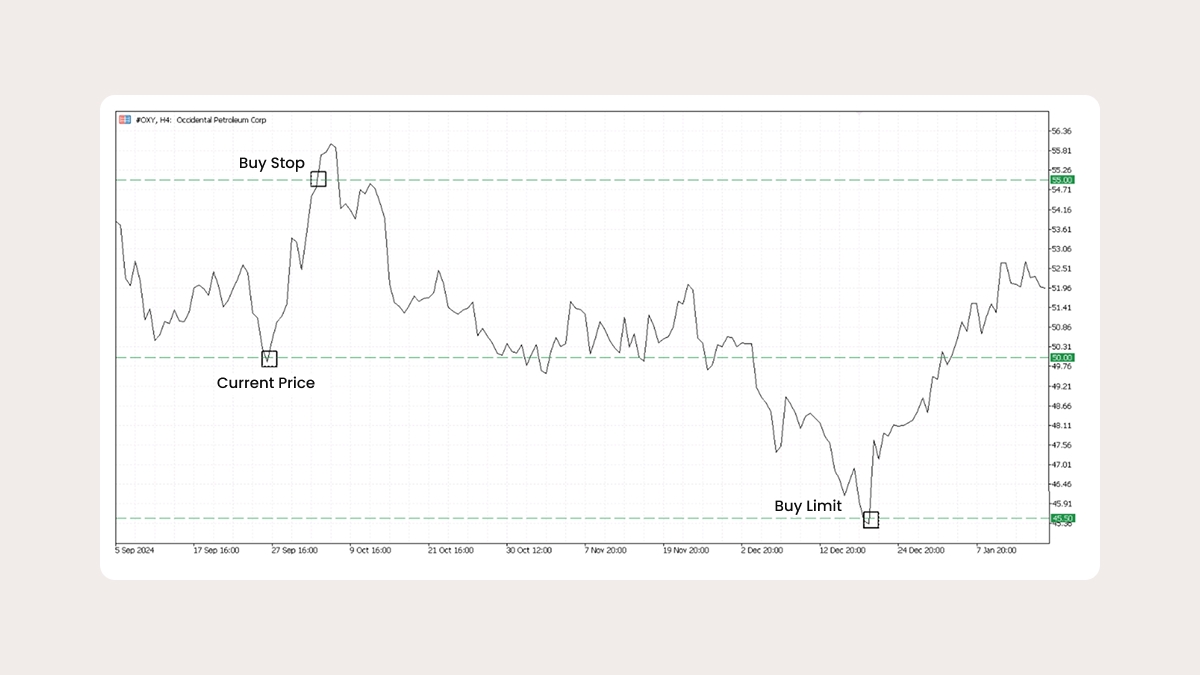

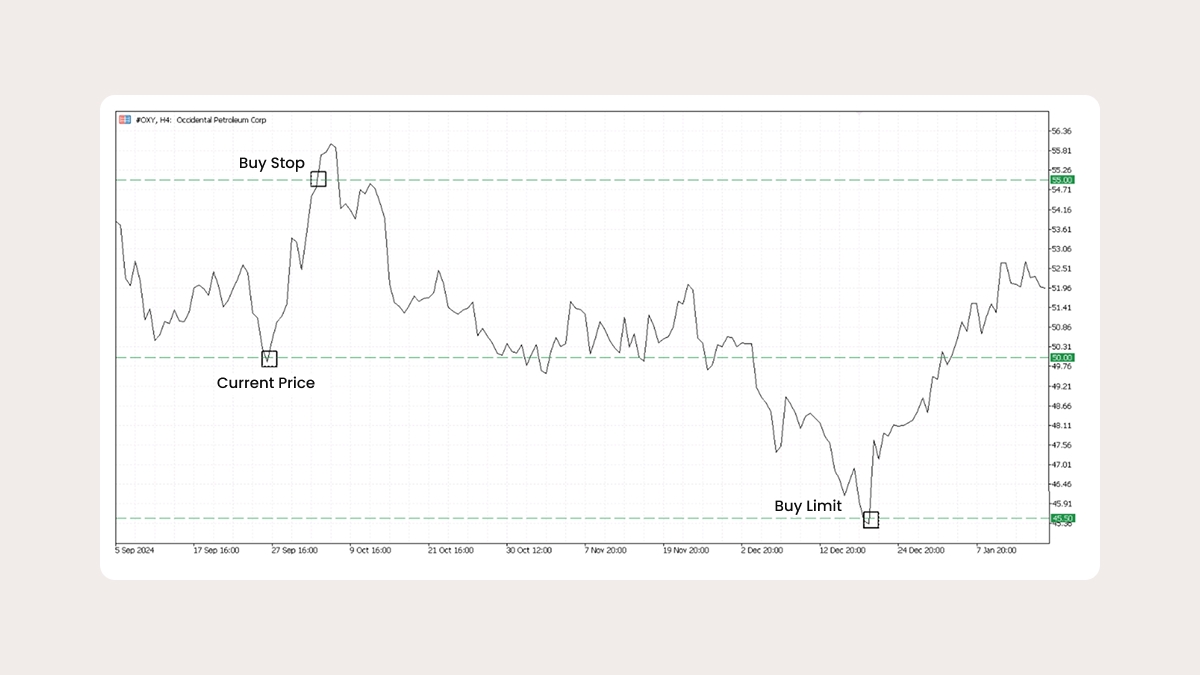

Example of a stop limit order

Consider a stock that is trading at $50. You feel that the price may reverse on reaching the $55 resistance level, and you want to buy it at the lower price, for example, if the price drops to $45. You set a buy stop limit order with the following settings:

If the stock price reaches $55, the limit order is set at $45. If the price reverses as you predicted and reaches $45, your buy limit order will be executed. However, there is a risk that the price won't reach the $45 level, and your trade will not be executed.

When to use a stop limit order

A stop limit order can be beneficial in several trading scenarios, including:

Avoiding slippage: Ensures that the trade executes only at a predefined price, preventing unexpected price fluctuations from affecting execution.

Strategic trading: This is particularly useful in volatile markets where price swings can be significant, as it allows traders to set precise entry and exit points.

Price averaging in case of drawdown: Helps traders manage risk by averaging their positions in the event of a market downturn, minimizing potential losses.

While these are common applications, the effectiveness of a stop limit order ultimately depends on each trader’s unique strategy, market conditions, and risk tolerance.

Pros and cons of stop limit orders

Despite being a flexible and convenient trading tool, stop limit orders also come with certain drawbacks. Below are some of the key advantages and disadvantages of using this order type:

Pros:

Price control: Ensures execution only at the limit price or better, preventing unfavorable price movements.

Risk management: Helps traders limit losses and implement price averaging strategies.

Market slippage prevention: Prevents execution at undesirable prices, especially during high volatility periods.

Cons:

Missed trading opportunities: If the limit price is too restrictive, the order may not be executed, potentially causing traders to miss out on profitable trades.

Active monitoring required: Traders must set prices carefully and keep an eye on market conditions to ensure their orders are executed as expected.

Long wait time: Depending on market conditions, it may take a significant amount of time for all the conditions of a stop-limit order to be met and executed.

Like any auxiliary tool, stop limit orders help traders improve their trading opportunities, but they require careful study and correct use. They do not guarantee instant profit but can be a valuable asset when applied strategically in a well-planned trading approach.

Summary

A stop limit order is a sophisticated and versatile trading tool that provides traders with precise control over trade execution. It helps manage risk, minimizes slippage and allows trading at predetermined price levels, helping traders to cut losses and preserve their capital. In addition, this type of order can be useful for averaging positions during pullbacks.

However, the successful use of a stop limit order requires a thorough understanding of the market structure and the ability to assess execution risks. Traders must remain vigilant to avoid missing trading opportunities due to restrictive price conditions.

When used strategically, stop limit orders allow traders to increase their efficiency, improve decision making, and execute well-planned trades in dynamic and rapidly changing markets.