Fundamental Analysis

Spot gold (XAU/USD) is steady near 2567.79 after rebounding from a two-month low of 2530, impacted by the strong US dollar and Jerome Powell’s recent speech. The US Dollar Index (DXY) reached a year-to-date high, bolstered by persistent inflation, a robust labour market, and Powell’s optimistic comments describing the US economy as "remarkably strong." This outlook strengthens the USD while weighing on gold due to its non-yielding nature.

The outlook for US interest rates remains pivotal for XAU/USD. Powell indicated the Fed would not rush to cut rates given the economy’s solid performance, diverging from prior expectations of monetary easing. Today’s US Retail Sales data could significantly influence the USD and gold. A result exceeding the projected 0.3% increase may further support the dollar, intensifying bearish pressure on the precious metal.

Other factors affecting gold include reduced positions by large hedge funds and outflows from ETFs, which have recorded a net drop of 12 tonnes in November according to the WGC. Nonetheless, gold retains support as a safe-haven asset amid elevated geopolitical risks. However, progress in ceasefire negotiations in Lebanon might limit this underlying support.

Technical Analysis

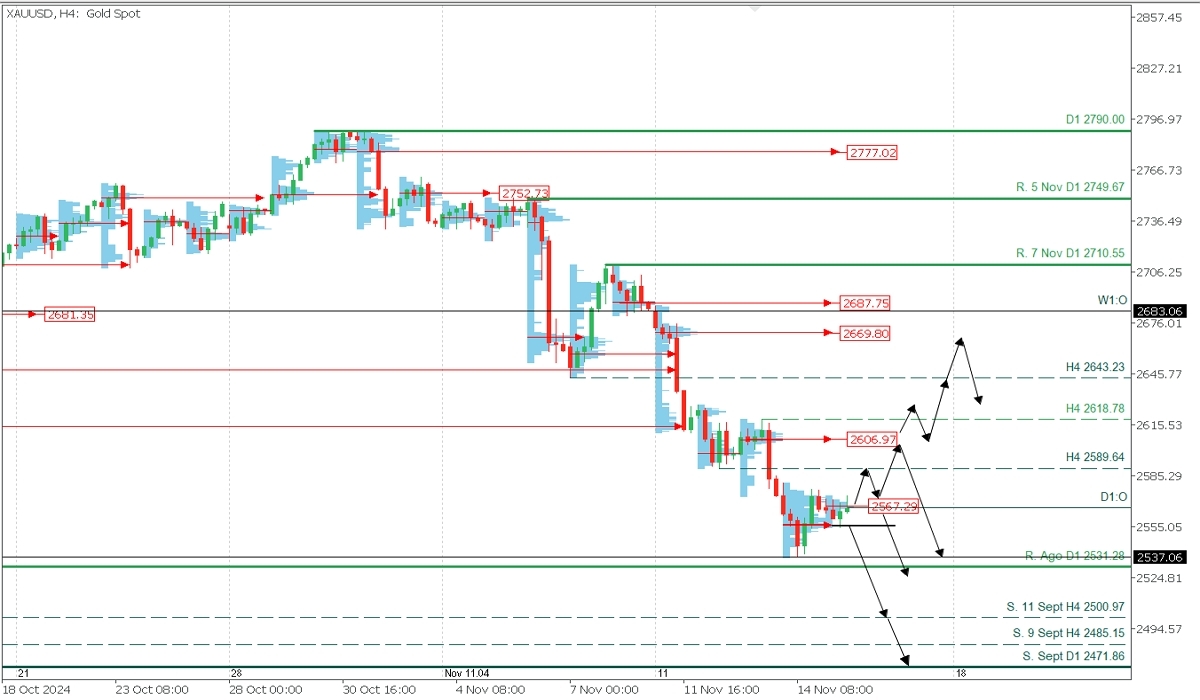

XAUUSD, H4

- Supply Zones (Selling): 2606.97 and 2669.80

- Demand Zones (Buying): 2567.29, 2556.43, and 2500

Gold has reached a key demand zone from September after breaking the August resistance. If prices stay above recent volume concentrations and the current demand zone (CDZ) between 2567.29 and 2556.43, a broader correction could be triggered.

Bullish Scenario (Correction):

If prices rise above 2568, expect a correction toward the broken support at 2589.64 or further to the uncovered POC from Wednesday at 2606.97, near the last intraday resistance at 2618.78. A decisive break of 2618.78 may shift the trend, targeting 2643.23, now acting as resistance, and the next supply zone at 2669.80.

Bearish Scenario (Post-Correction):

If resistance at 2618.78 holds, expect a continuation of selling, targeting support at 2537 and a break below 2530 toward the 2500 support from September 11. An early bearish scenario may emerge if prices fall below 2565, heading towards 2530, 2520, 2510, and 2500.

Technical Summary

- Bullish Correction Entry: Buy above 2574 with TP at 2589.64 and 2600. Only a break above 2618.78 justifies further upside to 2643, 2650, and 2669. Use a 1% SL with a low lot size for flexibility.

- Post-Correction Bearish Entry: Sell below 2600 after forming and confirming a PAR* on M5, with TP at 2567 and 2537. Use a 1% SL.

- Early Bearish Entry: Sell below 2565 after confirming a PAR*, with TP at 2530, 2520, 2510, and 2500. Use a 1% SL with a low lot size for flexibility.

Always wait for the formation and confirmation of a Pattern of Exhaustion/Reversal (PER) on M5 before entering trades in the indicated zones.

Glossary:

- Uncovered POC: The Point of Control (POC) is the level with the highest volume concentration. It acts as resistance if followed by a downward move or as support if succeeded by an upward move.

- PER: A Pattern of Exhaustion/Reversal used to validate entry points.

For more details, see our guide: Trading Strategies on Key Zones.