NZDUSD remains steady as markets digest Adrian Orr’s resignation. Key support lies at 0.6050, while resistance is at 0.6150. The pair could experience volatility as policy uncertainties unfold.

Fundamental Factors Affecting NZD

- Adrian Orr’s Resignation: Orr’s early departure introduces longer-term uncertainty, but near-term policy remains unchanged.

- Regulatory Easing Possibilities: The government may review restrictive capital rules, which could affect banking capital flows and interest rate differentials.

- New RBNZ Leadership Impact: The next governor could shape monetary policy—hawkish leadership may slow rate cuts, while a dovish approach could accelerate easing.

- Market Response: The New Zealand rates curve may steepen as policy shifts emerge, potentially impacting NZD sentiment.

Key Takeaway for Traders

While Orr’s resignation does not impact short-term policy, uncertainty around the next governor’s stance could influence NZD movements. Traders should monitor regulatory developments and RBNZ leadership signals, which may affect rate expectations and capital flows.

GBPNZD – H4 Timeframe

.png)

After a series of bullish breaks, we see the price fully retrace to sweep the induced low on the 4-hour timeframe chart of GBPNZD. The bearish retracement has caused a shift in the market structure, but until the demand zone gets invalidated, the sentiment on GBPNZD will remain bullish.

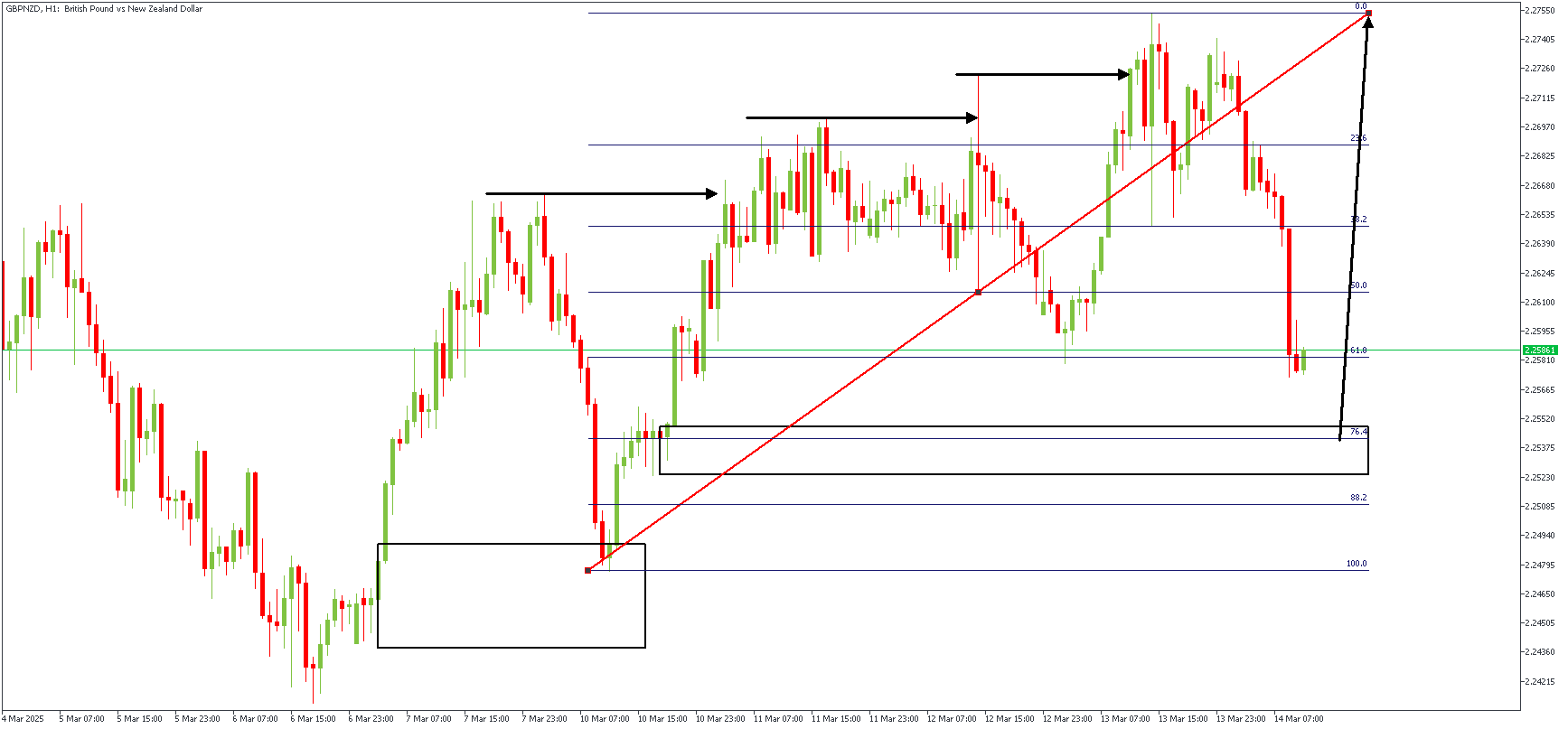

GBPNZD – H1 Timeframe

The 1-hour timeframe chart of GBPNZD shows the demand zone overlaps the 76% region of the Fibonacci retracement tool, with an FVG and sweep of liquidity from the induced low serving as additional confluences in favor of the bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target- 2.27527

Invalidation- 2.24730

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.