Tesla (TSLA) surged 7.4% to close at $248.09, marking its most substantial single-day rebound in two months. The stock remains volatile, recovering from a 38% year-to-date decline. Key resistance levels lie at $255 and $270, while support is around $240 and $230.

Fundamental Factors Affecting TESLA

- Cooling Inflation: February's CPI data came in lower than expected (0.2% MoM vs. 0.3% forecast), easing rate hike fears and boosting risk assets like Tesla.

- Tariff Uncertainty Eases: Concerns over potential U.S. tariffs on China, Canada, and Mexico have weighed on Tesla's cost structure, but the inflation data suggests a less immediate impact.

- Morgan Stanley Upgrade: The bank raised Tesla's price target to $250 from $230, citing optimism around its AI and robotaxi plans.

- Retail Investor Influence: Tesla's high retail ownership (30% float) contributed to the sharp rebound as dip-buying momentum kicked in.

Key Takeaway for Traders

A mix of macroeconomic relief and company-specific catalysts drives Tesla's short-term rally. If inflation remains subdued, tech stocks, including Tesla, could sustain gains. However, resistance at $255 will be crucial for further upside. Watch upcoming economic data and Tesla's AI/robo-taxi developments for additional market direction.

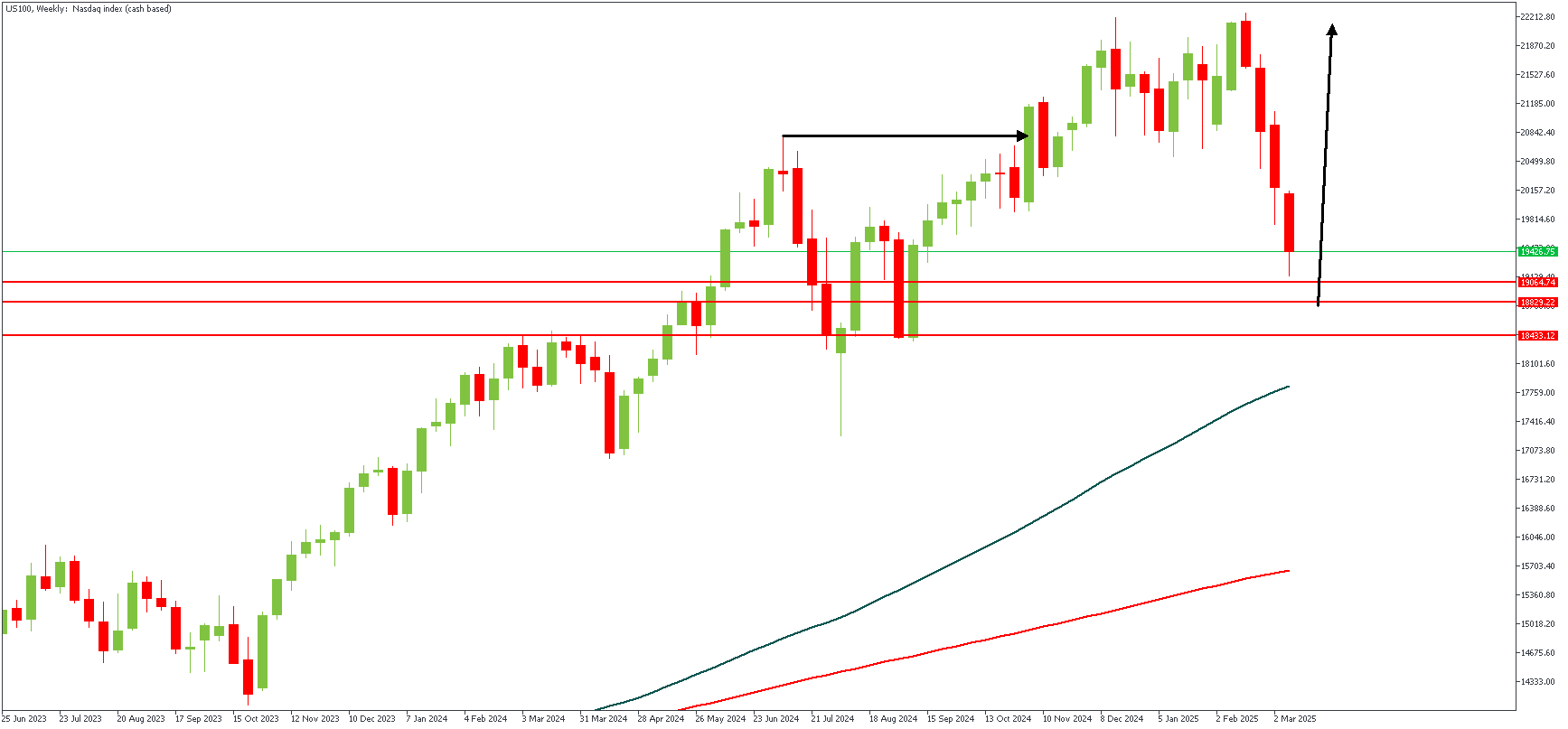

US100 – W1 Timeframe

When the price broke above the previous high on the Weekly timeframe chart of US100, the bullish impulse was confirmed. The retracement kicked off from the current swing high and aimed for the demand zone at the origin of the bullish momentum. Noticeably, there is a pivot region underlying the demand zone, and the moving average indicates the likelihood of a bullish outcome.

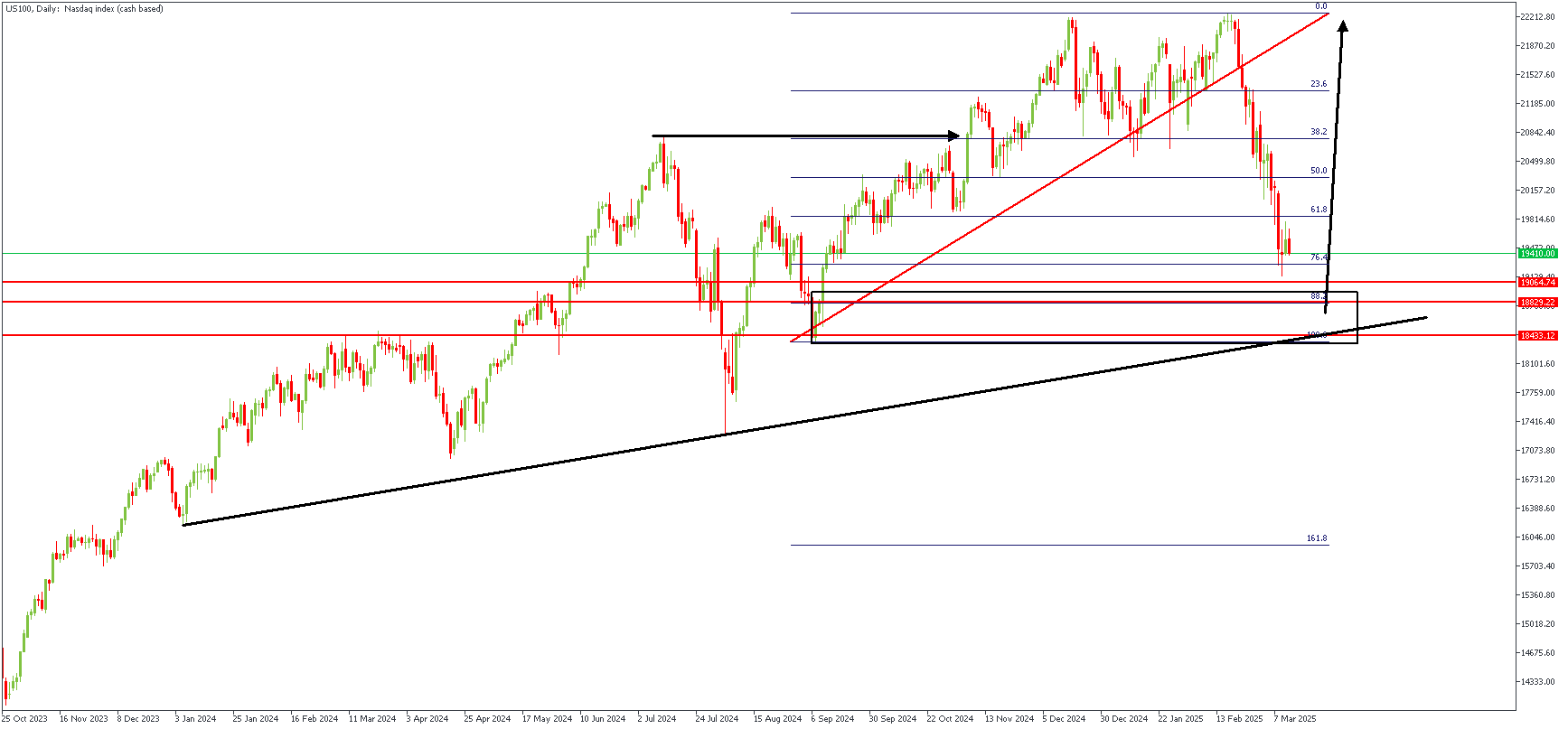

US100 – D1 Timeframe

The daily timeframe chart of US100 delivers more details about the overlap between the demand zone and the pivot region. It also highlights the trendline support and the Fibonacci retracement region from which we expect the bulls to attempt a recovery of the trend's momentum.

Analyst's Expectations:

Direction: Bullish

Target- 21494.86

Invalidation- 17951.38

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.