XBRUSD Teknik Analizi Brent petrol fiyatlamalarında resesyon endişelerine bağlı talebin azalacağına yönelik beklentiler ile satış baskıları arttı…

2022-06-23 • Güncellendi

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production. The surprise, however, is that prices didn't calm down and remained high.

OPEC+ decided to ramp up production. Members agreed to increase their overall production targets by 650,000 barrels per day in July and August. These increases are an attempt to ease the burning oil prices that threaten the global economic growth and push US gasoline prices to record levels.

1. Once China ends lockdowns and fully reopens its economy, demand for oil will rise, meaning oil prices will rise again.

2. In the US, demand is still strong with the start of the summer driving and travel season, despite record gasoline prices.

3. Demand is increasing while supply and production problems persist. We have Russian barrels leaving the market, OPEC is struggling to produce the required quotas, and the US is unable to increase production.

Small OPEC+ countries, in particular, haven't been able to produce their agreed quotas of supplies in recent months, leaving the group's production nearly 2.6 million barrels per day below the target.

The problem is that when OPEC cut production after demand collapsed due to the pandemic, investment fell, and facilities maintenance was also neglected. That made increasing production more difficult since then. And yes, OPEC+ decided to increase production, but the possibility of those barrels reaching the market is low.

OPEC + may succeed in increasing production only by 355,000 barrels per day in the next two months. That will increase pressure on prices, pushing them higher. According to EIA, this slight increase won't be enough to offset the disappearance of 3 million barrels per day of Russian oil from markets soon.

There are reasons to believe that if oil reaches the level of $140 a barrel, many regions of the world will plunge into recession.

As a result, both Goldman Sachs and Bank of America predict $140 a barrel for oil prices in the coming months. Moreover, the UAE Energy Minister said that oil prices aren't even near their peak, and the Chinese economy's reopening soon will support oil demand.

Oil prices are expected to calm down once production increases and the Chinese economy reopens. In the long term, prices will fall to more reasonable levels.

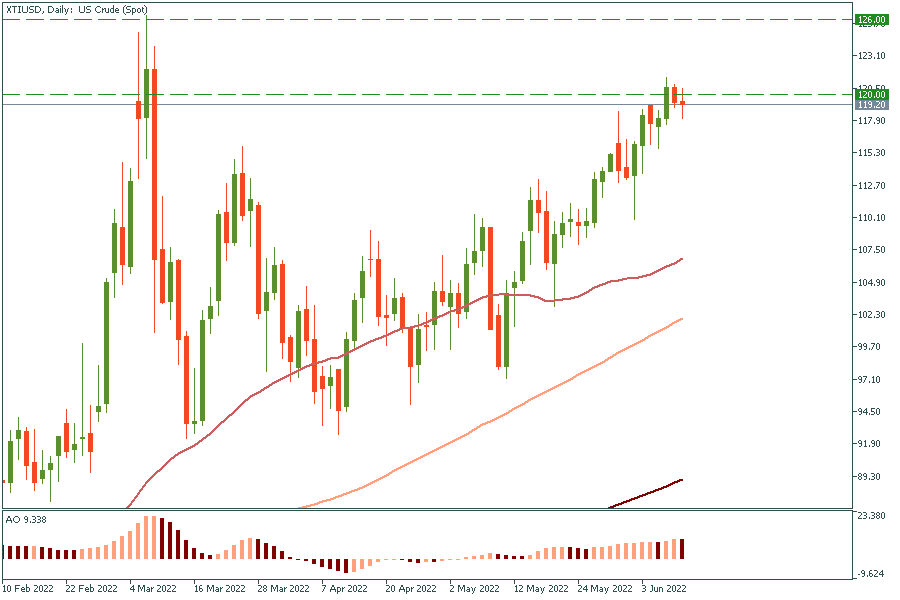

WTI faced minor corrections but remained above $120 levels, and prices may move in a vertical upside move and ease a bit before resuming the rally. The next target will be to break its highest level since the beginning of 2022, over $126.00 a barrel.

XBRUSD Teknik Analizi Brent petrol fiyatlamalarında resesyon endişelerine bağlı talebin azalacağına yönelik beklentiler ile satış baskıları arttı…

Ham Petrol Teknik Analizi Haftanın en önemli gelişmelerinden olan FED faiz kararı takip edilirken, beklentiler dahilinde FED ‘agrasif’ bir adım attı ve 75 baz puanlık faiz artış yoluna gitti…

XBRUSD Teknik Analizi Brent Petrol’de Çin’deki önlemlerin gevşetilmesi ve talebe yönelik olumlu seyir tekrardan canlanması fiyatlamalara yansıyor…

GBPUSD paritesinde 1…

USDTRY paritesinde alıcı iştahı devam ediyor ancak kritik bir direnç alanına yaklaştık…

Altında Powell Etkisi Yükselişleri Destekledi Ons altın Fed Başkanı Powell'ın faiz artış hızını düşürebileceğine işaret eden açıklamalarıyla yükselişini ikinci güne taşıdı…

FBS bu web sitesini çalıştırmak için verilerinizin kaydını tutar. “Kabul Et” düğmesine basarak, Gizlilik politikamız kabul etmiş olursunuz.

Talebiniz kabul edildi.

Bir yönetici sizi kısa süre içinde arayacaktır.

u telefon numarası için bir sonraki geri arama talebi

sonra olabilir

Eğer acil bir sorununuz varsa lütfen bizimle iletişime geçin

Canlı sohbet

İç hata. Lütfen daha sonra tekrar deneyiniz

Zaman kaybetmeyin - TDİ'nin ABD Dolarını ve kârı nasıl etkilediğini takip edin!